Blog Roundup: Discussion of TechCrunch post on the decline in VC returns

TechCrunch Blog Post: Ten-Year Venture Capital Returns Continue To Slide

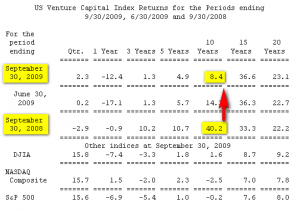

(Source: Cambridge Associates LLC via TechCrunch; The crude annotations are mine.)

Ouch.

There are lots of problems with this 8.4% 10-year rolling average return for venture capitalists in the US.

The big one, of course, is that when VC returns head into the 8% range, institutional investors who might otherwise plow an obligatory 1% into VC firms to cover their “alternative” category, start looking for less risky investments with similar return profiles.

And if those institutional investors start to go away, you end up with smaller VC funds and a big gap develops in the middle of your investment cycle, as it did from 2001 to 2003 – between the seed investors involved in early rounds and the larger, later-stage VCs, private equity funds and strategic industry investors who might participate in later rounds.

Of course, this should be a temporary problem: This is a rolling average and low returns can’t last for much longer, can they?

Or can they?

2010 is expected to be a year in which several technology company IPOs break the log-jam that has held up VC profits for the last couple of years and pushed the averages down dramatically.

But there is no repeat of 1998 and 1999 on the horizon, and those were years that contributed significantly to outsized VC returns, buoying up the 10-year rolling average. Until 2010, when those years rolled off.

Even if the returns head north again, they’re not going back to what they once were. And those were the returns that attracted the investors and built huge funds.

That leads to a larger question: Whither goeth the VC firm?

Whether the returns go back up a little or a lot, there has been serious discussion about the relevance of VC firms in the modern technology development cycle as the cost of software development, hardware development and manufacturing have plummeted.

Leaving things like pharma out of the discussion (but leaving a lot of biotech in the discussion), the way we innovate has changed and as a result the capital markets are gradually changing as well.

Low cost, agile short-run off-shore manufacturing, rapid prototyping options for everything from software to genemod, just-in-time digital supply chain management, crowd-sourced design and community syndication financing of new designs and products: They’re all starting to have an unforeseeable impact on the way new products and services come to market.

All of those trends mitigate towards lower costs to establish proof-of-concept and the ability for bad ideas to fail faster and for good ideas to succeed faster. That means less upfront capital required just to get products developed and into the market to discover whether the idea is good or bad.

Some commentators are taking this to the extreme and asking whether we really need venture capitalists anymore. Instead, do a lot of businesses really just need seed investors and then strategic investors and acquirers at the exit?

I don’t buy most of this “no-VC” hype: Rapid prototyping and direct web sales from manufacturer to consumer doesn’t mean you don’t still need capital to do complex engineering and kick off large-scale manufacturing for most products or to buy television airtime for marketing.

But it does mean that if you can test ideas faster and spend less on development and less on establishing and eliminating costly failures, you can push the entire average cost to launch a successful new venture downwards. And that has important implications.

We need VC firms, but those rolling averages are real, and they’re hitting the firms that have invested in bloated ventures or have a bloated model. Those firms will transform or die.

The ones that will survive into the next fund-raising generation will be smaller and nimbler, putting more smarts and fewer dollars into ventures, and they will learn to source deal flow through new and very different means.

The evidence is already here: We’re seeing the emergence of contests, camps and accelerators focused on extremely low-cost, rapid venturing to get products to test markets at lightening speed.

Forward-thinking VCs are using seed investment programs, university partnerships, contests, laboratories, and incubators to participate in the changing innovation marketplace, where the distance from idea to product is ever shorter and success or failure is measured in the time it takes to count the re-tweets.

The firms that survive will be those that raise reasonable amounts of deployable cash, and are the smartest of the “smart money.” These are the firms that focus exclusively on areas where their executive leadership has depth and experience and can bring value to a limited number of investments in an increasingly structured manner and in an extremely short period of time.

In the end, smaller, smarter VC firms are a good thing, even if fewer dollars are definitely not. The higher the proportion of investment dollars that go towards ventures that ultimately produce a successful business, the more competitive our economy will become.

Today, India and China have taken the low-end manufacturing business away and are solidly chewing on the middle. And they’re doing it strategically: China is making investments now with plans to lead the world in solar and wind energy hardware manufacturing.

The only way for the US economy to stay competitive is through innovation, and we have to do it on fewer dollars and in fewer months than we had a decade ago. Not just because of the recession, but because that’s how the competition is gaining on us: They spend fewer dollars to deliver innovation and they’re doing it systematically.

It may be painful in the short term, but letting bad ideas fail faster and good ideas succeed faster, with fewer dollars spent to get the result, makes the innovation process a lot leaner. And that is exactly what we need right now to stay competitive.

Need help with your business? Contact JumpPhase.com

Kraettli Lawrence Epperson

Latest posts by Kraettli Lawrence Epperson (see all)

- Do entrepreneurs do their own taxes? - August 31, 2019

- A venture capital firm asks to interview you; What do you do? - August 31, 2019

- If I want to eventually start my own company, will product management experience help? - January 3, 2019